- Test results indicate that Kabanga nickel concentrate is amenable to processing using Lifezone Holdings Limited’s (“Lifezone Metals” or the “Company”) proprietary hydrometallurgical technology (“Hydromet Technology”) with pressure oxidation (“POX”) leach extractions for non-optimised test results equal to and over Ni 98.5%

- DRA Global Limited (“DRA Global”) appointed as lead Definitive Feasibility Study (“DFS”) consulting engineer and OreWin Pty Ltd. (“OreWin”) appointed as lead mining consultant and qualified persons

- Results of recent drilling largely consistent with location, thickness, and tenor of previous results from historical drilling. Key intersections include KN08-04A; 21.90 m at 3.85% Ni and 4.74% NiEq from 1,075.30 m downhole and KN22-03; 39.83 m at 3.03% Ni and 3.65% NiEq from 244.10 m downhole

- Memorandum of Understanding (“MoU”) signed with Tanzania Electric Supply Company Limited (“TANESCO”) for project power supply

- Environmental studies progress for Kabanga mine and Kahama refinery

- Lifezone Metals announced on December 13, 2022 a business combination agreement with GoGreen Investments Corporation (NYSE: GOGN). The business combination between Lifezone Metals and GoGreen Investments Corporation is subject to customary closing conditions, including regulatory approvals

February 3, 2023, 06:00AM Eastern Standard Time

Dar es Salaam, Tanzania – Lifezone Metals is pleased to provide an update on progress on the Definitive Feasibility Study and resource definition drilling programme at the Kabanga nickel project (“Kabanga” or the “Kabanga Project”) in North-West Tanzania. We believe Kabanga is one of the world’s largest and highest-grade undeveloped nickel deposits, which is expected to offer a new source of more sustainable metals.

Following the appointment of DRA Global to undertake the DFS for the Kabanga Project and Kahama refinery, and to coordinate and manage input from all specialist consulting companies, study work is now underway across all technical disciplines.

Planning for Kabanga’s early works programme is progressing, which includes an aerodrome and internal roads infrastructure. The programme also includes the resource definition drilling programme on the North and Tembo portions of the Kabanga orebody to support the geological resource model and mine planning for the DFS.

Metallurgical and Refinery Testwork

DRA Global is advancing the metallurgical refining testwork programme using Lifezone Metals’ proprietary Hydromet Technology, which has the potential to significantly reduce carbon emissions in battery metals refining compared to traditional smelting and refining. Two POX leach tests were conducted to provide a preliminary indication of refinery metal recoveries. POX leach extractions for these non-optimised tests were: Ni 99%, Cu 97%, and Co 98% for POX test 1 and Ni 99%, Cu 99%, and Co 99% for POX test 2. These results indicate that Kabanga nickel concentrate is amenable to processing using Lifezone Metals’ Hydromet Technology.

Metallurgical testwork continues for the concentrator confirmation testwork and development of the refinery flowsheet. The scope of this work has been awarded to DRA Global’s in-house hydrometallurgical specialist team.

Environmental Management Plan and Infrastructure

Upholding international standards and frameworks is a key driver of Lifezone Metals’ Environmental Social Governance (“ESG”) strategy, particularly as the Kabanga Project is in definition phase. Both the Lifezone Metals and Tembo Nickel Corporation Limited (“Tembo Nickel”) teams are focused on uplifting the Environmental and Social Impact Assessment (“ESIA”) work to current international standards through gap analyses and additional studies over the next 12–18 months.

MTL Consulting Company Limited (“MTL”) completed updates to the Kabanga Environmental Management Plan and registered it with the National Environment Management Council (“NEMC”) in Tanzania. The Kahama Refinery ESIA studies have also advanced, with detailed studies underway.

Recently, Tembo Nickel signed an MoU with TANESCO for the supply of electricity to the Kabanga Project and Kahama refinery.

Work with other key Tanzanian infrastructure providers is progressing, including discussions with Tanzania National Roads Agency regarding upgrades to support the planned transport of concentrate from the Kabanga mine to Kahama refinery.

Following a site visit by the Tanzania Civil Aviation Authority, the aerodrome study has confirmed that the proposed area at the Kabanga site and presented design is suitable for an 80-seater aircraft1. Construction of the aerodrome and supporting infrastructure is planned to commence in 2023.

1. Typical 80-seater aircraft Dash 8 Q400

MoU discussions with Deputy MD Peter Kigadye, TANESCO (second from left), and the Kabanga Project team – Gerick Mouton, Lifezone Metals COO (left), Sauda Simba, Tembo Nickel Public Relations Consultant, and Benedict Busunzu, Tembo Nickel Country Manager (October 2022).

Resource Definition Drilling

Drilling highlights of the 2021 and 2022 drilling campaigns:

North Zone:

KN08-04A: 21.90 m at 3.85% Ni and 4.74% NiEq from 1,075.30 m downhole

KN08-21A: 24.74 m at 2.72% Ni and 3.50% NiEq from 1,012.42 m downhole

KN08-21B: 24.67 m at 2.84% Ni and 3.65% NiEq from 1,011.55 m downhole

KN08-61A: 42.30 m at 2.81% Ni and 3.53% NiEq from 915.72 m downhole

KN22-03: 39.83 m at 3.03% Ni and 3.65% NiEq from 244.10 m downhole

Tembo Zone:

KL21-01: 23.67 m at 2.36% Ni and 3.06% NiEq from 370.18 m downhole

KL21-02: 21.28 m at 1.98% Ni and 2.62% NiEq from 572.28 m downhole

KL22-01: 19.53 m at 2.17% Ni and 2.92% NiEq from 372.95 m downhole

KL22-10: 33.18 m at 2.21% Ni and 2.85% NiEq from 365.00 m downhole

Since Tembo Nickel obtained Special Mining Licence SML 651/2021 (“SML”) in October 2021, field activities at the Kabanga Project have resumed, including the recommissioning of the camp and initiation of diamond drilling.

From the date of grant of the SML through the end of 2022, a total of 40 diamond drillholes were completed for a combined metreage of 13,094.5 m (“recent drilling”). This recent drilling was conducted over three campaigns:

- November 2021 through May 2022: Collection of metallurgical samples for the North and Tembo zones from 16 drillholes (4,218 m of diamond core). Nine of the metallurgical holes were drilled from surface (totalling 4,000 m) and the remaining eight holes were short wedges from existing parent holes. The resultant metallurgical bulk sample material has been sent to Perth, Australia for hydrometallurgical test work.

- June 2022 through November 2022: Confirmatory drilling at the Tembo and Safari zones totalling 21 drillholes (7,848.5 m of diamond core) to provide contemporary verification of the location and tenor of the previous results from historical drilling. This drilling largely comprised new from-surface holes (18 holes, 7,029.9 m), with the remaining three holes being wedges.

- In December 2022, an extensive programme of infill and proximate drilling was commenced. The primary focus of this work is to develop contemporary standards for input into the DFS.

This drilling programme, which commenced with three resource definition drillholes at the Tembo North zone (1,028 m), is planned to provide infill coverage as required along the full strike length of the known mineralisation at Kabanga, from Main zone in the south-west to Safari zone in the north-east – a total strike length of some 7.5 km.

In addition to resource definition drilling, this DFS drilling programme will involve the extensive collection of samples for geotechnical, metallurgical, and hydrological purposes.

We believe the results of the recent drilling have been encouraging, having largely confirmed the location, thickness, and tenor of previous results from historical drilling.

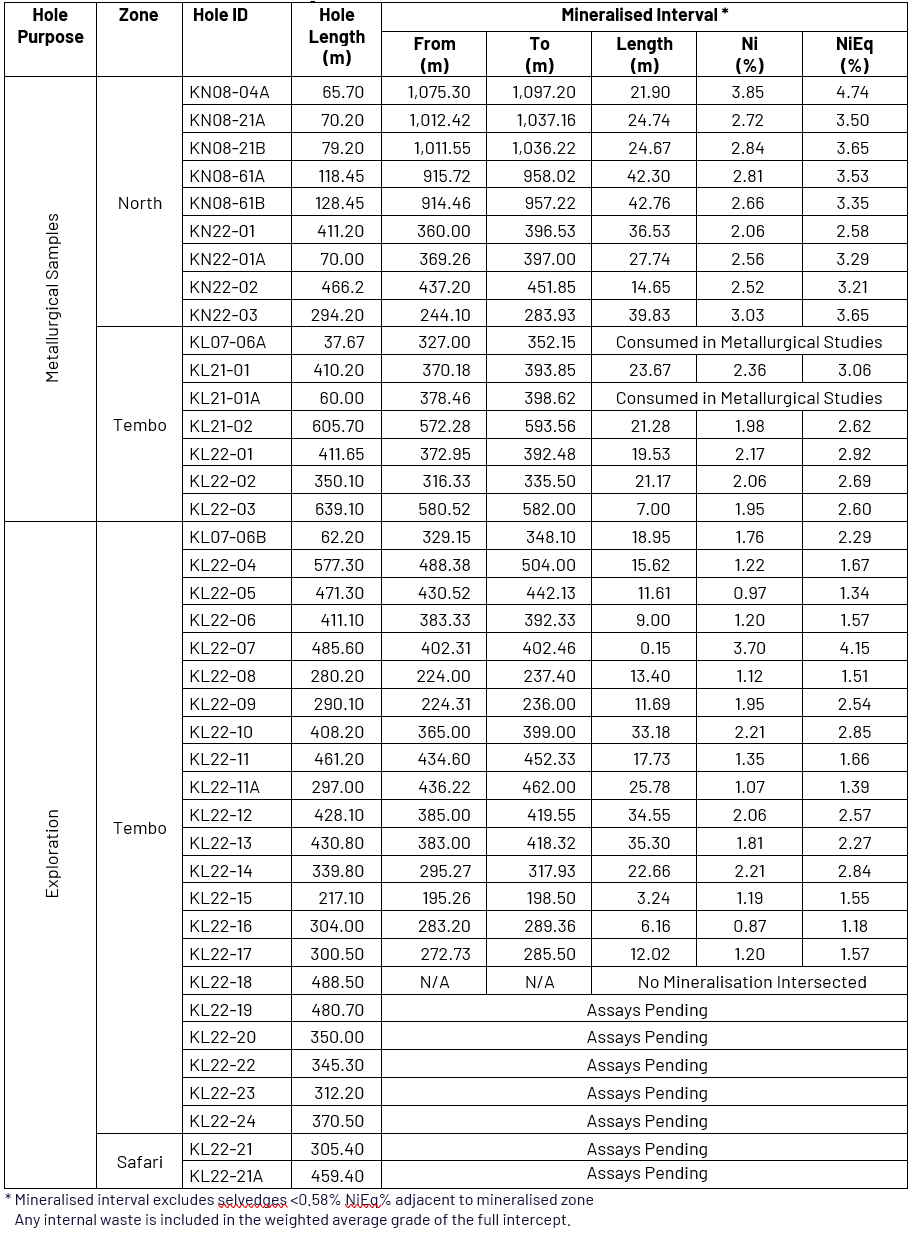

A list of the recent drilling completed on SML 651/2021 to the end of December 2022 is shown in Table 1, including, where assays are currently available, notable mineralised intercepts (including length-weighted average nickel-equivalent grade (NiEq) (%)). Any internal waste is included in the weighted average grade of the full intercept.

Assaying is routinely undertaken on 1.0 m samples, with reduction in sample length permitted to honour changes in lithology or style of mineralisation. Assaying is conducted at SGS laboratories in Johannesburg, South Africa and Mwanza, Tanzania. The analyses undertaken are Na peroxide fusion/ICP analysis; FA/ICP assays; sulphur analysis by ICP/Infrared/CS Analyzer; Ag by AAS; and SG determination by pycnometer. Check assaying of approximately 10% of the results is undertaken at Nesch Mintech laboratory in Mwanza, where Ni, Cu, and Co assays are undertaken by 4-acid microwave digestion with ICP/plasma-atomic emission spectrometer finish and sulphur analyses by Infrared/CS Analyzer. QA/QC insertion includes Certified Reference Materials standards, blanks, and pulp duplicates.

NiEq is calculated by Tembo Nickel using the formula: Ni% + Cu% x 0.411 + Co% x 2.765. Intercepts shown in Table 1 exclude below cut-off (<0.58% NiEq%) selvedges at the top and bottom of the mineralised intercept.

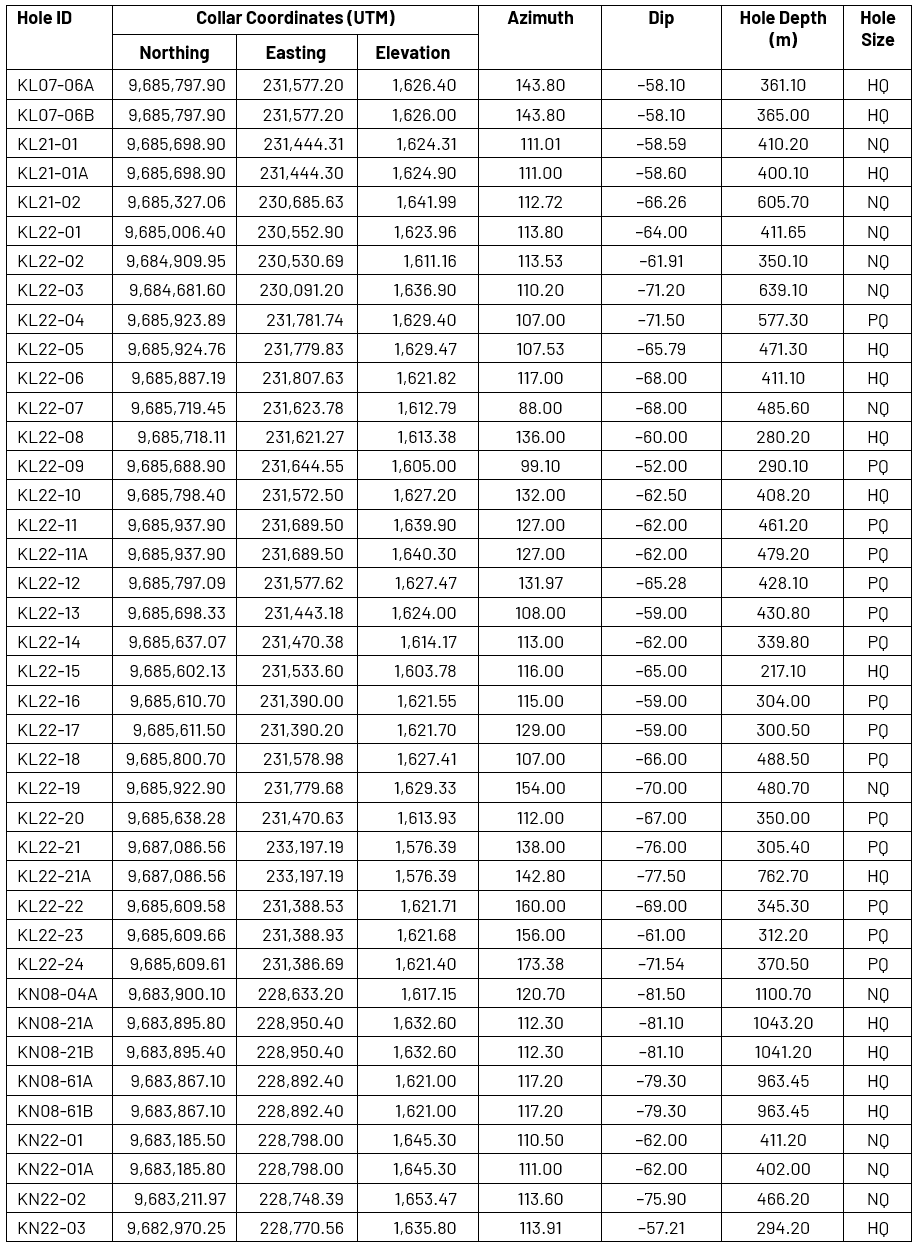

Drilling has been completed exclusively by diamond drilling, with holes collared in PQ diameter to drill through the highly weathered quartzite, then downsizing to HQ diameter down to 300–600 m, and then typically finishing in NQ diameter for drilling into the deeper parts.

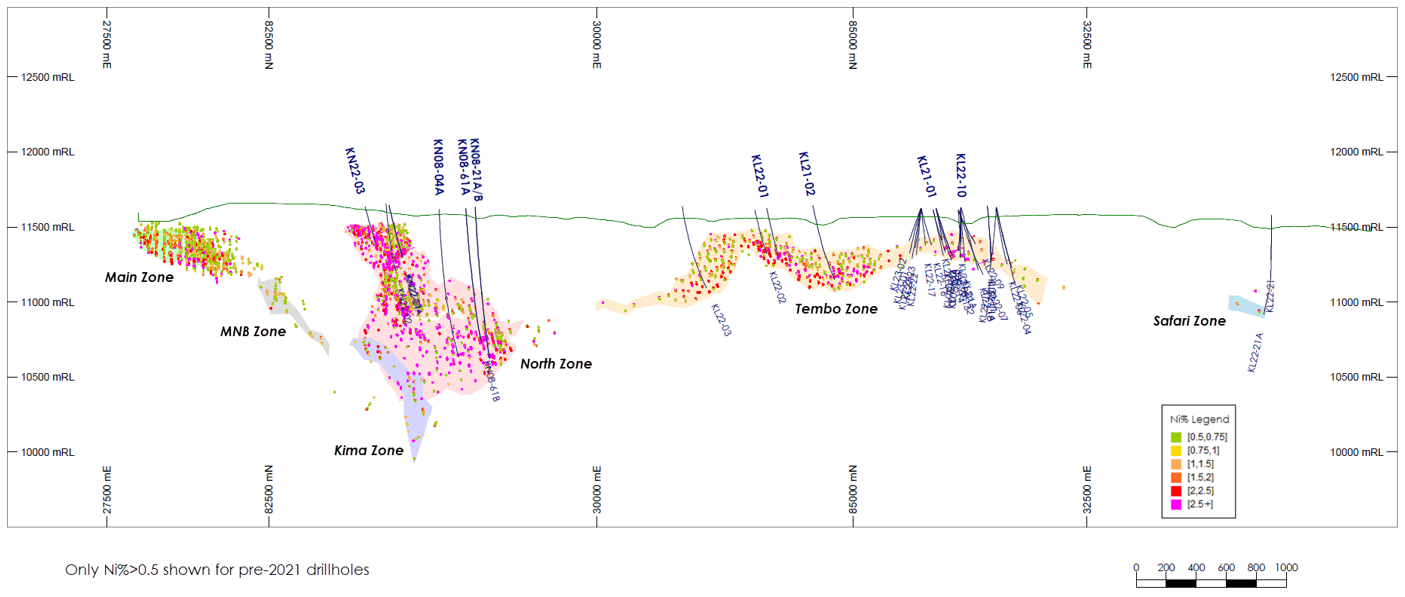

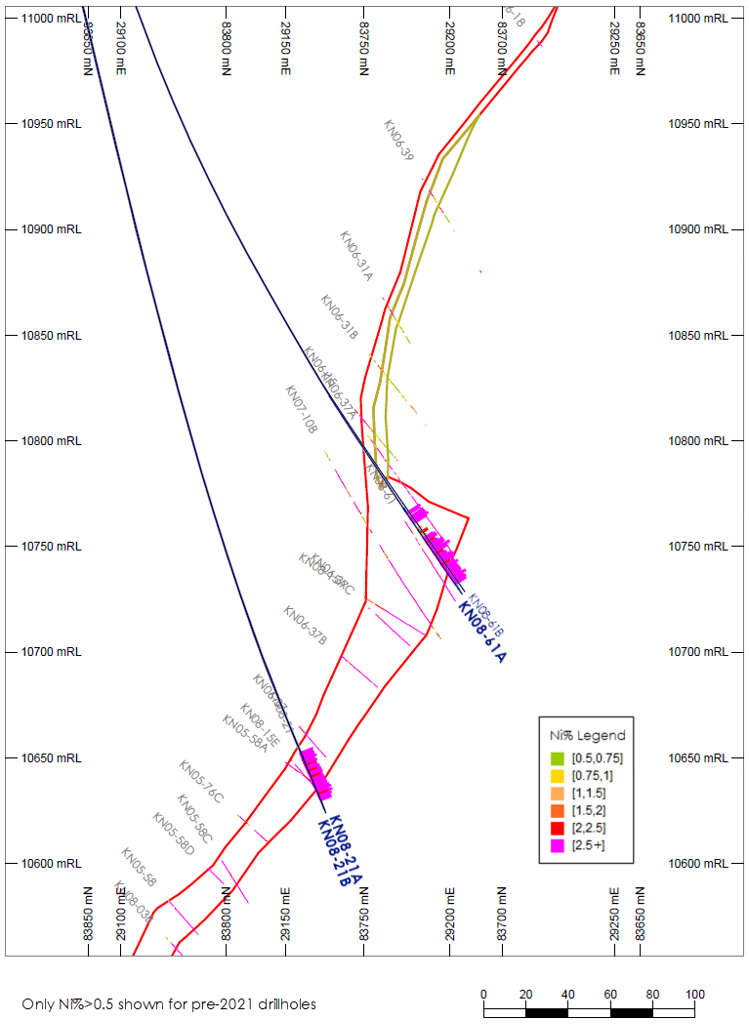

Core recovery for the recent drilling has resulted in an average of 98.7% recovery overall. A projected long section, showing the full drillhole traces of the recent drilling, together with the drillhole intercepts of the pre-2021 drilling where Ni%>0.5 and historical mineralisation interpretations, is shown in Figure 1. An example cross section is shown in Figure 2.

Drillhole collar locations are surveyed in UTM ARC 1960 grid using differential GPS in units of metres. Drillhole collar details are shown in Table 2. The drillhole data is subsequently converted to the MG09 grid by subtracting 200,000 from the easting and 9,600,000 from the northing and adding 10,000 to the elevation.

“As we conduct detailed studies to optimise Kabanga’s annual output, we are also encouraged that the extensive infill drilling we are undertaking has increased our understanding of the project. The intersections reflected in the drilling results show the quality of the Kabanga Project and the thickness of this world-class orebody.” Chris Showalter, Lifezone Metals’ CEO, said. “The extensive work underway on the Definitive Feasibility Study for Kabanga is key to optimising development of the Kabanga mine and Kahama refinery to realise its true value and benefit all shareholders.”

Table 1: List of Recent Drilling Completed on SML 651/2021 between November 2021 and December 2022, showing Length-Weighted Average NiEq% Grade of the Mineralised Interval (where assays are available)

Figure 1: Projected Long Section showing Post-2021 Drillhole Traces and Historical Ni%>0.5 Assays and Mineralisation Interpretations

Figure 2: Example Cross Section showing Post-2021 Drillhole Trace and Historical Ni%>0.5 Assays and Mineralisation Interpretations

Table 2: Drill Collar Coordinates of Recent Drilling Completed on SML 651/2021 between November 2021 and December 2022

About Lifezone Metals

Lifezone Metals is a modern metals company creating value across the battery metals supply chain from resource to metal and recycling. Lifezone Metals aims to responsibly and cost-effectively provide supply chain solutions to the global battery metals market. The Company seeks to solve battery supply-chain challenges through pairing one of the largest and highest-grade undeveloped nickel sulphide deposits in the world with its proprietary hydromet technology, to produce cleaner metals. Its tailored hydromet technology is a cleaner and lower cost alternative to smelting, and the Company is partners with BHP in Tanzania with the aim of developing world-class battery metal assets. Lifezone Metals is a champion for Tanzanian metals production. Its aim is to empower Tanzania to be the next premier source of nickel, with the goal to achieve full value in-country. Lifezone Metals’ mission is to provide commercial access to patented technology and battery metals through a scalable platform.

About Tembo Nickel Corporation

Tembo Nickel is an operating company formed via the framework agreement (the “Framework Agreement”) entered into in January 2021 between Kabanga Nickel Limited and the Government of Tanzania (the “GoT”) for development of the Kabanga nickel deposits in the Ngara District in the Northwest of Tanzania. Tembo is the Swahili word for elephant and represents strength and cooperation. Under the Framework Agreement terms, the GoT holds a 16% non-dilutable free-carried interest in Tembo Nickel and Kabanga Nickel Limited holds the remaining 84% interest. The Framework Agreement includes provisions setting out the arrangement in relation to the conduct of future mining operations, the grant of the GoT’s non-dilutable free-carried interest in Tembo Nickel and its participation in mining and the financing of any future mining operations.

About GoGreen Investments Corporation

GoGreen Investments Corporation is a blank check company formed for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses. GoGreen is led by Chief Executive Officer John Dowd.

Contacts

Lifezone Metals

Natasha Liddell

Executive Vice President ESG & Communications

info@lifezonemetals.com

Media Enquiries

Tom Batchelar

TAB Communications

tom@tabcommunications.co.uk

+44 (0)7814 964 287

Daniel Thole

Fletcher Advisory

daniel@fletcheradvisory.com

+44 (0) 7821 571 308

Qualified Person

The exploration results disclosed in this news release were prepared under the supervision of and approved by Sharron Sylvester, RPGeo AIG (10125), who is employed by OreWin as Technical Director–Geology. Ms. Sylvester has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and is the qualified person for purposes of Subpart 1300 of Regulation S-K (“S-K 1300”). The scientific and technical information concerning the exploration results discussed in this news release have been reviewed and approved by the qualified person.

Forward-Looking Statements

Certain statements made herein are not historical facts but may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the “safe harbor” provisions under the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook” or the negatives of these terms or variations of them or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding future events, the proposed business combination between GoGreen Investments Corporation (“SPAC”) and Lifezone Metals, the estimated or anticipated future results and benefits of the combined company following the business combination, including the likelihood and ability of the parties to successfully consummate the business combination, future opportunities for the combined company, including the efficacy of Lifezone Metals’ Hydromet Technology and the development of, and processing of mineral resources at, the Kabanga Project, and other statements that are not historical facts.

These statements are based on the current expectations of SPAC and/or Lifezone Metals’ management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of SPAC and Lifezone Metals. These statements are subject to a number of risks and uncertainties regarding Lifezone Metals’ business and the business combination, and actual results may differ materially. These risks and uncertainties include, but are not limited to: general economic, political and business conditions, including but not limited to the economic and operational disruptions and other effects of the COVID-19 pandemic; the inability of the parties to consummate the business combination or the occurrence of any event, change or other circumstances that could give rise to the termination of the business combination agreement; the number of redemption requests made by SPAC’s shareholders in connection with the business combination; the outcome of any legal proceedings that may be instituted against the parties following the announcement of the business combination; the risk that the approval of the shareholders of Lifezone Metals or SPAC for the potential transaction is not obtained; failure to realize the anticipated benefits of the business combination, including as a result of a delay in consummating the potential transaction or difficulty in integrating the businesses of Lifezone Metals and SPAC; the risk that the business combination disrupts current plans and operations as a result of the announcement and consummation of the business combination; the risks related to the rollout of Lifezone Metals’ business, the efficacy of the Hydromet Technology, and the timing of expected business milestones; Lifezone Metals’ development of, and processing of mineral resources at, the Kabanga Project; the effects of competition on Lifezone Metals’ business; the ability of the combined company to execute its growth strategy, manage growth profitably and retain its key employees; the ability of Lifezone Metals Limited (“Holdings”) to obtain or maintain the listing of its securities on a U.S. national securities exchange following the business combination; costs related to the business combination; and other risks that will be detailed from time to time in filings with the U.S. Securities and Exchange Commission (the “SEC”). The foregoing list of risk factors is not exhaustive. There may be additional risks that Lifezone Metals presently does not know or that Lifezone Metals currently believes are immaterial that could also cause actual results to differ from those contained in forward-looking statements. In addition, forward-looking statements provide Lifezone Metals’ expectations, plans or forecasts of future events and views as of the date of this communication. Lifezone Metals anticipates that subsequent events and developments will cause Lifezone Metals’ assessments to change. However, while Lifezone Metals may elect to update these forward-looking statements in the future, Lifezone Metals specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lifezone Metals’ assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements. Nothing herein should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or results of such forward-looking statements will be achieved.

Certain statements made herein include references to “clean” or “green” metals, methods of production of such metals, energy or the future in general. Such references relate to environmental benefits such as lower green-house gas (“GHG”) emissions and energy consumption involved in the production of metals using the Hydromet Technology relative to the use of traditional methods of production and the use of metals such as nickel in the batteries used in electric vehicles. While studies by third parties (commissioned by Lifezone Metals) have shown that the Hydromet Technology, under certain conditions, results in lower GHG emissions and lower consumption of electricity compared to smelting with respect to refining platinum group metals, no active refinery currently licenses Lifezone Metals’ Hydromet Technology. Accordingly, Lifezone Metals’ Hydromet Technology and the resultant metals may not achieve the environmental benefits to the extent Lifezone Metals expects or at all. Any overstatement of the environmental benefits in this regard may have adverse implications for Lifezone Metals and its stakeholders.

Additional Information and Where to Find It

In connection with the business combination Holdings intends to file with the SEC a registration statement on Form F-4, which will include a preliminary prospectus and preliminary proxy statement and, after the registration statement is declared effective, SPAC will mail a definitive proxy statement/prospectus and other relevant documents relating to the business combination to its shareholders. This communication is not a substitute for the registration statement, the definitive proxy statement/prospectus or any other document that SPAC will send to its shareholders in connection with the business combination.

INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS COMBINATION AND THE PARTIES TO THE BUSINESS COMBINATION. Investors and security holders will be able to obtain copies of these documents (if and when available) and other documents filed with the SEC free of charge at www.sec.gov. The definitive proxy statement/final prospectus (if and when available) will be mailed to shareholders of SPAC as of a record date to be established for voting on the business combination. Shareholders of SPAC will also be able to obtain copies of the proxy statement/prospectus without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: GoGreen Investments Corporation, One City Centre, 1021 Main Street, Suite 1960, Houston, TX 77002.

Participants in the Solicitation

Holdings, Lifezone Metals, SPAC and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed participants in the solicitation of proxies of SPAC’s shareholders in connection with the business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the business combination of the directors and officers of Holdings, Lifezone Metals, SPAC in the registration statement on Form F-4 to be filed with the SEC by Holdings, which will include the proxy statement of SPAC for the business combination. Information about SPAC’s directors and executive officers is also available in SPAC’s filings with the SEC.

No Offer or Solicitation

This communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.